devcon 7 / does ethereum really need pbs solving mev at the app vs the infrastructure layer

- YouTube

- Details

Does Ethereum Really Need PBS? Solving MEV at the app vs the infrastructure layer

Duration: 00:24:35

Speaker: Felix Leupold

Type: Lightning Talk

Expertise: Intermediate

Event: Devcon

Date: Nov 2024

In this talk, we will give a brief history of MEV (Maximal Extractable Value) and its influence on enshrining PBS (Proposer Builder Separation) into Ethereum. We will explore the Ethereum community’s evolving perspectives on PBS while looking at successful outcomes, unexpected consequences, and alternate solutions.

Ultimately, the talk will provocatively ask: does Ethereum really need PBS at all?

Categories

- Related

Devcon

Talk

26:07

Towards Fairer DEXs on Ethereum

MEV is inherent to Ethereum and cannot be banned at the core protocol layer. Dapps should therefore carefully assess and reduce the amount of MEV they create. Multi-dimensional batch auctions with just in time competition for order flow offer a fundamentally fairer way of trading on Ethereum. P2P matching reduces the amount of extractable AMM interactions, while best price execution is guaranteed through a network of competing “solvers”.

Felix Leupold

Devcon

Talk

30:33

A Modest Proposal for Ethereum 2.0

Vitalik Buterin gives his talk titled, "A Modest Proposal for Ethereum 2.0"

Vitalik Buterin

Devcon

Talk

17:05

Nano-payments on Ethereum

Piotr Janiu of Golem (http://golemproject.net/) presents on Nano-payments on the Ethereum blockchain

Piotr Janiuk

Devcon

Talk

30:36

The CBC Casper Roadmap

The CBC Casper roadmap is a plan to implement Proof-of-Stake and Sharding for Ethereum using “correct-by-construction” (CBC) software design methodology. This talk will share new CBC Casper research, including specifications for light clients, liveness and sharding. It will include updates on formal verification and engineering efforts, and a roadmap for (eventual) release.

Vlad Zamfir

Devcon

Talk

22:18

Demand-based recurring fees in practice

ALL 4 letter .COMs have been taken since 2013. Yet most only have a few natural buyers; hence, speculation doesn't make that market more efficient. Yet, in crypto-economics, we can already transcend private property to deter the monopolization of digital assets like domains. This talk explores solutions from Weyl, Posner, and Henry George. We'll show how pricing and allocative efficiency can be improved through Georgist land value tax for assets like real estate, domain names, or ad space.

timdaub

Devcon

Talk

25:34

Voting with time commitment

Token-based voting mechanisms employed by DAOs can encounter three potential problems: plutocracy, Sybil attacks and vote buying. If one were to design a voting mechanism from scratch, how does one ensure that these issues are addressed adequately down the road? This talk aims to provide some intuition for the trade-offs faced when tackling these problems in general, and the role of time commitment in alleviating these issues, in particular.

Vijay Mohan

Devcon

Talk

22:54

Bootstrapping a block builder

The sessions aims to be a practical overview of how to go from zero to having a running and reasonably competitive builder (profits may vary). It aims to answer the following questions: - What software to run? How can this be customized? - What would need to go into writing a builder from the ground up? - How does one acquire orderflow? What is the relative value of various sources of orderflow? - What infrastructure is required? How much does it cost?

Sean Anderson

Devcon

Talk

25:33

Superliquid Mechanisms for Decentralized Stablecoins

USDC and USDT outpace decentralized stablecoins in large part due to their liquidity. This talk covers the theory, data, and risks of stablecoin liquidity innovations. This will include mint/redemption mechanism design, liquidity pool design, rehypothecation, and protocol-owned liquidity. The analysis will distill how the flexibility of decentralized stablecoin issuance mechanisms can safely be used to their advantage over centralized stablecoins, which Gyroscope v2 is putting into practice.

Ariah Klages-Mundt

Devcon

Talk

13:41

Synthetic Assets

Dominic Williams presents on Synthetic Assets at Ethereum's DEVCON1.

Dominic Williams

Devcon

Talk

20:54

A Standardized Business Model for Decentralized Insurance

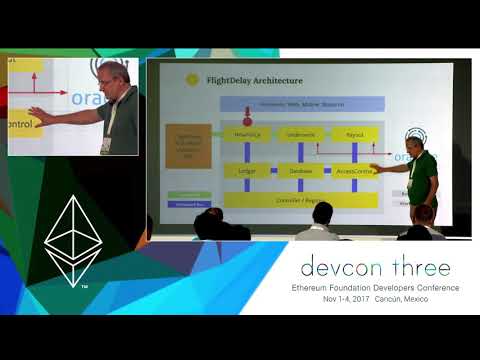

We at Etherisc are building the first decentralized insurance on the blockchain. Decentralized means that we are not building a company only, but a standardized protocol and a platform on which many participants can build insurance products and trade risks.

Christoph Mussenbrock