Watch / Prediction Markets Panel

Prediction Markets Panel

- YouTube

- IPFS

- Details

Prediction Markets Panel

Duration: 00:29:57

Speaker: Edmund Edgar, Vitalik Buterin, Jack Peterson, Martin Koppelmann, Stefano Bertolo

Type: Panel

Expertise: Advanced

Event: Devcon 1

Date: Nov 2015

Categories

Playlists

VB

Vitalik Buterin

Chief Scientist @ Ethereum Foundation

- Related

Liquidity on Blockchains

Casey Detrio presents on Liquidity on Blockchains with Batch Auctions and Smart Markets.

Casey Detrio

Nano-payments on Ethereum

Piotr Janiu of Golem (http://golemproject.net/) presents on Nano-payments on the Ethereum blockchain

Piotr Janiuk

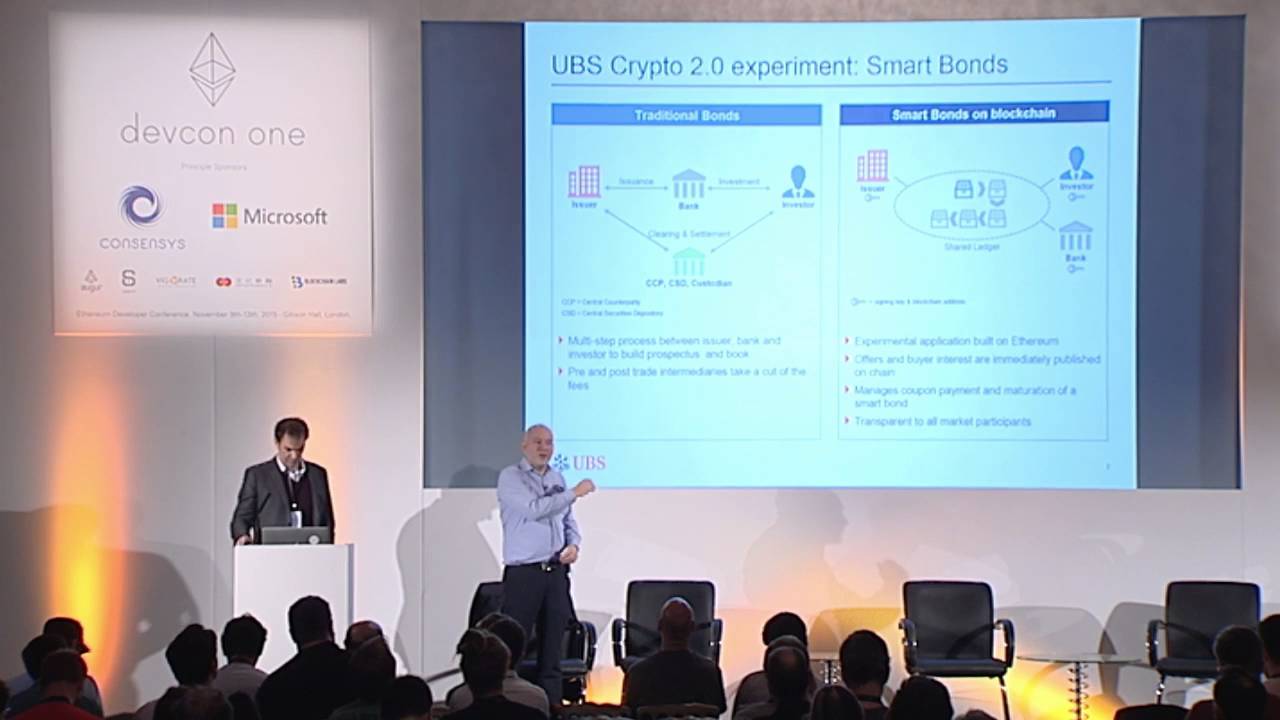

Smart Bonds

Stephan Karpischek and Ian Cusden of UBS (https://www.ubs.com/global/en.html) present on their Smart Bonds Platform built using the Ethereum software stack.

Stephan Karpischek, Ian Cusden

Synthetic Assets

Dominic Williams presents on Synthetic Assets at Ethereum's DEVCON1.

Dominic Williams

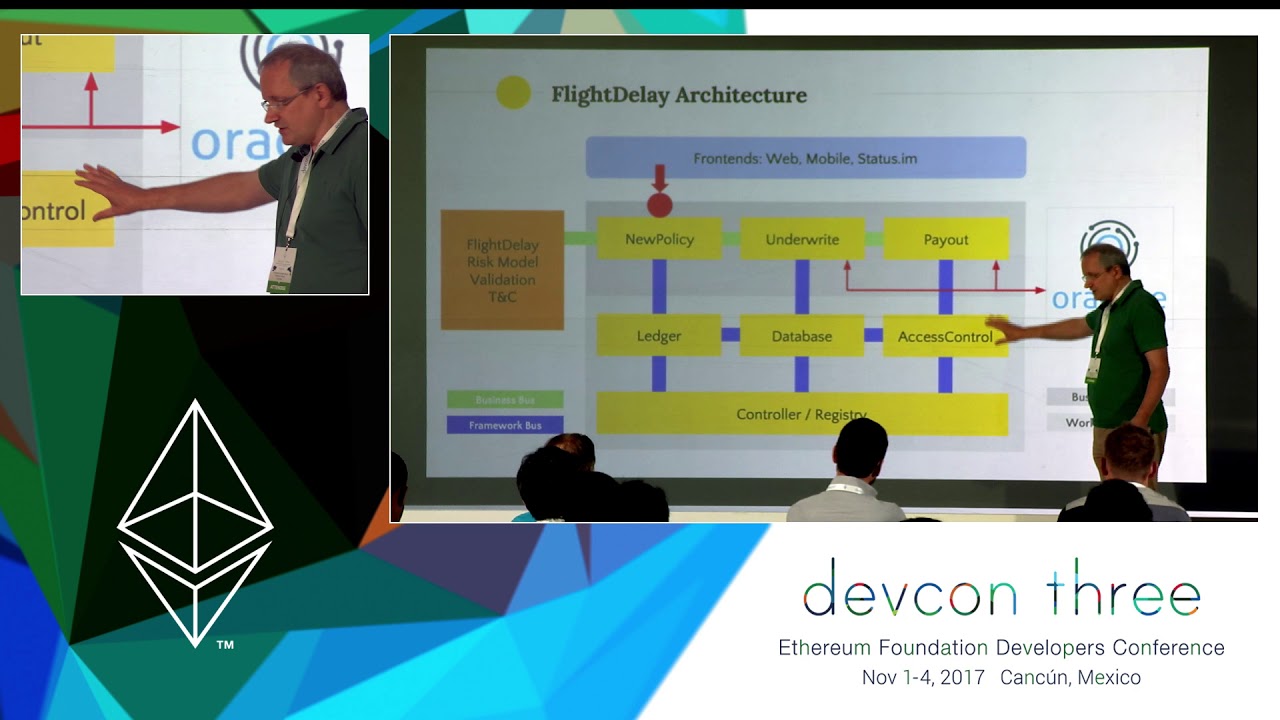

A Standardized Business Model for Decentralized Insurance

We at Etherisc are building the first decentralized insurance on the blockchain. Decentralized means that we are not building a company only, but a standardized protocol and a platform on which many participants can build insurance products and trade risks.

Christoph Mussenbrock

Dai Stablecoin

The process of developing the Dai Stablecoin System has matured significantly over the course of the last year. We innovated in the Ethereum community by being the first project to release a well-defined reference implementation, written in Haskell, for our proposed system. This effort has helped with the simplification of the system’s design, increased project efficiency, and has attracted the attention of formal verificiation specialists who now want to focus on Maker. It is becoming more and more likely that Maker will be the first non-trivial decentralized application to be formally verified before launch. In this proposed presentation, I would like to talk about the usefulness of rigorous specification and external reference implementations for the benefit of other Ethereum projects.

Andy Milenius

Programmable Incentives: Intro to Cryptoeconomics

Karl Floersch presents their talk titled, "Programmable Incentives: Intro to Cryptoeconomics"

Karl Floersch

A review of short term interest rates of tokens in the Ethereum Defi space, why they exist and how to interact with those smart contracts

This a review of the current interest rate economics in the Ethereum space. A quick look at loanscan.io will show tons of projects interacting with each other to create lending and borrowing opportunities. We are here to review why they exist and show on a practical level how to interact with these smart contracts. Most use cases will be earning a high-interest rate or getting a loan of a cryptocurrency.How do you make sure your money is safe, what risks are you taking, how is this different than lending/borrowing money in the "real" world? We will go through a practical example of taking USD and entering the crypto world, interacting with a smart contract and earning interest. The hope is to teach anyone to do this in 10 minutes.

Akash Patel

Economics of Ethereum 2.0

This will be a presentation reviewing the Ethereum 2.0 Economics for an average validator. The talk will highlight the validator economics based on the current spec that can be expected for Phase 0 and Ethereum 2.0 at a mature state. The presentation will result in a call for community feedback on the proposed economics, which will be done through a public facing Ethereum 2.0 calculator built by the EF and ConsenSys.

Collin Myers

Money and Debt and Digital Contracts

Brewster Kahle presents his talk on Money, Debt, and Smart Contracts.

Brewster Kahle

Shaky ERC20 Allowances

Sometimes, we can't see the forest for the trees. When not used carefully in dapps, ERC20 token allowances fit that description perfectly. This presentation goes into the story of how I accidentally put over 10,000 DAI at risk for my users, even if they only deposited 100 DAI in the smart contract per se.

Paul Razvan Berg

Shouldn’t we rethink debt? What DeFi can learn from susu’s and immigrant lending clubs

With hundreds of millions collateralized in products like Compound Finance and Maker, the Ethereum community is rightfully rallying around #DeFi. Yet, one could easily draw portentous parallels to the systemic risks of financial innovations in the early 2000s: credit default swaps, hybrid securities, and so on. In this lightning talk I will implore our community to look toward another concept of lending used around the world: the susu. The susu (tanda in Latin America, hui in Asia, or a “rotating savings and credit association: ROSCA), is a type of short-term no-interest loan among members of a small community. Each person in the susu makes the same contribution to the pool of money, and on a rotating basis, one person receives the total amount added to the pool. I first encountered this concept when visiting my partner’s family in Trinidad and Tobago, and am studying how communities in NYC rely on these informal lending clubs to pay for a flight, a home down-payment, or just for fun. If Ethereum will bring greater financial access, we should focus less on imitating the sophisticated financial products of Wall Street and instead look to the ways that communities without financial access already get by.

James Beck

Stablecoins

Rune Christensen, Victor Rortvedt, Dan Robinson & Eva Beylin participate in a panel on Stablecoins.

Rune Christensen, Victor Rortvedt, Dan Robinson, Eva Beylin

The Future of Value

Sep Kamvar speaks about the Future of Value.

Sep Kamvar

Transparent Dishonesty: Blockchain Front-running Taxonomy

Front-running has been an issue in financial instrument markets since the 1970s. With the advent of the blockchain technology, front-running has resurfaced in new forms we explore here, instigated by blockchains decentralized and transparent nature. In this paper, we draw from a scattered body of knowledge and instances of front-running across the top 25 most active decentral applications (DApps) deployed on Ethereum blockchain, and an instance of abnormal behaviour of a mining pool to participate in an ICO. We also introduce a taxonomy of front-running attacks on blockchain and map the proposed solutions to front-running into useful categories. Published at Financial Cryptography and Data Security 2019: https://arxiv.org/abs/1902.05164

Shayan Eskandari

We Come in Peace: Why VC Matters to Ethereum

Jehan Chu speaks about VCs in the ecosystem.

Jehan Chu

A Mechanism for Pricing Non-fungible Resources: Toward Multi-dimensional Fee Markets

We propose a new mechanism for multi-dimensional resource pricing in blockchains. Currently, many blockchain systems operate with either fixed transaction fees or fixed relative prices of different resources (e.g., compute, memory, storage). Our proposed mechanism prices resources independently and automatically in a way that maximizes some utility set by the protocol designer.

Theo Diamandis

Amplifying Consensus Participation with Blockspace Markets

In order to maximize staking participation post-merge, we need to provide capital markets for blockspace demand. This can come in the form of Yield Tokenization (e.g. Swivel, Element), blockspace reservations (e.g. Eden Network), or direct exchanges (e.g. Alkimiya), however composable infrastructure is necessary. With composable infrastructure on the capital markets layer, we can create interesting instruments such as combined staking+lending+options products, and derivative stablecoins.

Julian Traversa

An Overview of AMM Mechanisms

The talk will give an exhaustive overview of the different AMM algorithms currently deployed on major distributed ledgers, as well as the underlying intuition behind their design. Building up from the basic principles of AMM design, the talk will then cover the algorithmic mechanisms used in the various different algorithms including Constant Sum, Constant Product (Uniswap V2), Uniswap V3, KyberSwap, StableSwap (Curve), CryptoSwap (Curve V2), Solidly Stable pairs, Clipper, Dodo, and RFQ systems.

Matt Deible

Block building after the Merge

We are seeing the emergence of a specialized role on the Ethereum network dedicated to assembling the contents of each block as the ecosystem grows and the impact of "maximum extractable value" (MEV) becomes clear. This talk investigates block building after the Merge and what considerations the move to proof-of-stake brings to the process along with what norms we should strive for to avoid dangerous centralization pressures while maximizing validator profits.

Alex Stokes

Compositionality: The 10x Engineer Secret Sauce

Proponents of blockchains argue that compositionality is a key feature. What is compositionality though? Maybe surprisingly, there is a rich mathematical framework in which the concept can be made precise as a theory of systems. In this workshop, we provide a primer of that theory and we showcase two practical applications based on it: compositionality in game theory (open games) and in formal verification (automata). The workshop is aimed at devs. There are no mathematical prerequisites.

Fabrizio Romano Genovese, Philipp Zahn

Cost of Feudalism: Towards a Theory of MEV

Maximal Extractable Value (MEV) is excess value captured by miners/validator. This excess value often comes from reordering, censoring, or inserting new transactions that allow a miner to front-run users' transactions. Is MEV *always* bad? Can it sometimes lead to good equilibria for users? We modify tools from algorithmic game theory and probability to prove some surprising paradoxes — *some* MEV improves trading efficiency in networks of automated market makers.

Tarun Chitra, Guillermo Angeris

Cryptoeconomics Dive: LP Volatility Harvesting Across Yield Rates

This talk furthers the concept of volatility harvesting. Currently, Uniswap and other major dexes see a huge part of their trading volume consist of the result of volatility in the market. Value changes and as a result, trading volume spikes and LPs profit. When extending yield, which is also quite a volatile concept, to AMMs, volatility harvesting is increased further to not only affect value but also the yield that value creates.

Will Villanueva

Designing Autonomous Markets for Stablecoin Monetary Policy

We discuss the design of primary (i.e., minting and redemption) market mechanisms for non-custodial stablecoins. We first introduce a new analytical tool, the *redemption curve*, which represents the redemption price as a function of redemption pressure. We use it to discuss historical de-peggings (e.g. in DAI, UST). We then describe a new dynamic redemption curve with desirable robustness properties and show how to implement a primary market based on this curve. The system is part of Gyroscope.

Ariah Klages-Mundt, Steffen Schuldenzucker

Economic Incentives and Souls in Schelling-point Based Oracles

Schelling-point based oracles, such as Kleros, can be used to attribute soulbound tokens (SBTs) to individuals based on subjective evaluations of their backgrounds and expertise. Moreover, mechanisms using SBTs can complement economic incentives in such oracles; for example, an SBT-conscious random selection process can determine the voters on a given question. We will focus on how the interplay of economic and social elements in such systems can be designed to maximize resistance to attacks.

William George

Evaluating the PBS Experiment: Early insights from MEV-Boost and the Builder Market

PBS is a major change to the core Ethereum protocol. It attempts to minimise negative effects of MEV by delegating block building to a market of block builders. This talk would cover what we have learned from the rollout of mev-boost, focusing on what is happening in the builder market, and what this means for the future of in-protocol PBS. What are the main improvements that we can make to the PBS design in response to how this prototype version is performing?

Jolene Dunne

GHO

An overview of The Aave Companies' Gho proposal and implementation. Gho, a native decentralized, collateral-backed stablecoin, GHO, pegged to USD, has been proposed to the Aave DAO.

Steven Valeri

HyperCerts for Regenerative Cryptoeconomics

How do we incentivize and reward high-impact bets on valuable projects like infrastructure?Regenerative cryptoeconomics intends to combine a cultural paradigm shift with web3 tooling to incentivize positive externalities in a financially sustainable way. Evan will describe specific tools, instruments, and mechanisms; share developmental achievements made so far; and describe how those directions can improve the chances that the world will be improved with user-empowering, web3 driven tech.

Evan Miyazono

MEV NFT: ERC-721 Fork for Blocking Atomic Arbitrage

Inspiration MEV (miner extractable value) is an issue that often times disbenefits the smaller consumers or traders. While traditional MEV research is mostly focussed on sandwich trades, we focus on one specific type of extractable value: MEV NFT! Let's illuminate the dark forest. In the talk we present a novel way to analyse and detect NFT arbitrage for more transparency. With that research we design a ERC-721 token that blocks malicious bots and could benefit consumers.

Franz

One Block, One Batch: Examining the Potential of Frequent Batch Auctions in Ethereum

This talk will focus on the future of (de)centralized trading, and examine how frequent batch auctions can revolutionize existing market economics by bringing fairness and protection to Ethereum’s various stakeholders. We will review why Ethereum would benefit from a global batch settlement layer, touching on MEV and unfair pricing of CFMMs.

Anna George

Reinforcement Learning for Query Pricing in The Graph

Indexers in The Graph protocol use a DSL called Agora to map query shapes to prices. However, manually populating and updating Agora models for each query is a tedious task, and, as a consequence, most indexers default to a flat pricing model. We have created and deployed reinforcement learning agents for Indexers to automatically compete on pricing. This talk will focus on our development process and our study of the market effects of multiple competing pricing agents.

Tomasz Kornuta

Security Risks in DeFi: Delineating Technical and Economic Security

The frenetic evolution of DeFi makes it hard to understand its principles and risks. In our talk, We delineate DeFi along the axes of primitives, protocol types and security risks. We distinguish technical security, which has a healthy literature, from economic security, which is largely unexplored, connecting the latter with new models and thereby synthesizing insights from computer science and economics. Finally, we outline the open research challenges across these security types.

Daniel Perez, Ariah Klages-Mundt, Lewis Gudgeon

The Fight for MEV

The Fight for MEV is a talk that focuses on the two most "famous" MEV solutions designs, CowSwap and Flashbots. It will go over the differences in how each model is designed, and why each solution has made those choices (users, objectives). We will end on how we see the future at CowSwap in relation to the merge, MEV, and the overall Ethereum DeFi ecosystem.

Alex Vinyas

This is MEV

MEV has largely been a field where engineering drives science, it’s now time for science to drive engineering: we present an axiomatic formalization of MEV, the theory based on it, and the new applications that it enables.

sxysun

This is not MEV.

As a nascent field, cryptoeconomics is still lacking in terms of formal definitions upon which a cohesive theoretical edifice can be built. Maximal Extractable Value (MEV) is a particular example of a technical concept where there is no widely agreed upon formalization. Here, we discuss the difficulties in arriving to such a formulation, and survey some proposals. Critically, we emphasize what MEV is *not*, highlighting the critical aspects that need to be encompassed in its definition.

Alejo Salles

Towards Fairer DEXs on Ethereum

MEV is inherent to Ethereum and cannot be banned at the core protocol layer. Dapps should therefore carefully assess and reduce the amount of MEV they create. Multi-dimensional batch auctions with just in time competition for order flow offer a fundamentally fairer way of trading on Ethereum. P2P matching reduces the amount of extractable AMM interactions, while best price execution is guaranteed through a network of competing “solvers”.

Felix Leupold

Ultra Sound Money

This talks paints a big picture for ETH the asset and its macro cashflows. We discuss unique dynamics arising from: * **fee burn** (ETH for blockspace payments) * **issuance** (ETH for validator incentivisation) * **staking** (ETH for economic security) * **defi collateral** (ETH for economic bandwidth)

Justin Drake

Updates on Proposer-Builder Separation

In this talk, I will discuss updates on PBS and economic models for validators, builders, searchers and users.

Barnabé Monnot

Validator Receipts: an Alternative to Liquid Staking Derivatives

Liquid staking derivatives are exciting and powerful, however come with centralization risk and the dangers of holding a derivative rather than its underlying asset. Validator receipts present an alternative mechanism by which Ether locked in staking can be used as collateral without exposure to derivatives or loss of control of the validating funds.

Steve Berryman