devcon 6 / this is not mev

- YouTube

- IPFS

- Details

This is not MEV.

Duration: 00:17:59

Speaker: Alejo Salles

Type: Talk

Expertise: Intermediate

Event: Devcon

Date: Oct 2022

As a nascent field, cryptoeconomics is still lacking in terms of formal definitions upon which a cohesive theoretical edifice can be built. Maximal Extractable Value (MEV) is a particular example of a technical concept where there is no widely agreed upon formalization. Here, we discuss the difficulties in arriving to such a formulation, and survey some proposals. Critically, we emphasize what MEV is *not*, highlighting the critical aspects that need to be encompassed in its definition.

Categories

- Related

Devcon

Talk

17:05

Nano-payments on Ethereum

Piotr Janiu of Golem (http://golemproject.net/) presents on Nano-payments on the Ethereum blockchain

Piotr Janiuk

Devcon

Talk

30:33

A Modest Proposal for Ethereum 2.0

Vitalik Buterin gives his talk titled, "A Modest Proposal for Ethereum 2.0"

Vitalik Buterin

Devcon

Talk

17:34

Amplifying Consensus Participation with Blockspace Markets

In order to maximize staking participation post-merge, we need to provide capital markets for blockspace demand. This can come in the form of Yield Tokenization (e.g. Swivel, Element), blockspace reservations (e.g. Eden Network), or direct exchanges (e.g. Alkimiya), however composable infrastructure is necessary. With composable infrastructure on the capital markets layer, we can create interesting instruments such as combined staking+lending+options products, and derivative stablecoins.

Julian Traversa

Devcon

Talk

25:07

Evaluating the PBS Experiment: Early insights from MEV-Boost and the Builder Market

PBS is a major change to the core Ethereum protocol. It attempts to minimise negative effects of MEV by delegating block building to a market of block builders. This talk would cover what we have learned from the rollout of mev-boost, focusing on what is happening in the builder market, and what this means for the future of in-protocol PBS. What are the main improvements that we can make to the PBS design in response to how this prototype version is performing?

Jolene Dunne

Devcon

Talk

26:44

The Fight for MEV

The Fight for MEV is a talk that focuses on the two most "famous" MEV solutions designs, CowSwap and Flashbots. It will go over the differences in how each model is designed, and why each solution has made those choices (users, objectives). We will end on how we see the future at CowSwap in relation to the merge, MEV, and the overall Ethereum DeFi ecosystem.

Alex Vinyas

Devcon

Talk

26:07

Towards Fairer DEXs on Ethereum

MEV is inherent to Ethereum and cannot be banned at the core protocol layer. Dapps should therefore carefully assess and reduce the amount of MEV they create. Multi-dimensional batch auctions with just in time competition for order flow offer a fundamentally fairer way of trading on Ethereum. P2P matching reduces the amount of extractable AMM interactions, while best price execution is guaranteed through a network of competing “solvers”.

Felix Leupold

Devcon

Talk

13:41

Synthetic Assets

Dominic Williams presents on Synthetic Assets at Ethereum's DEVCON1.

Dominic Williams

Devcon

Talk

20:54

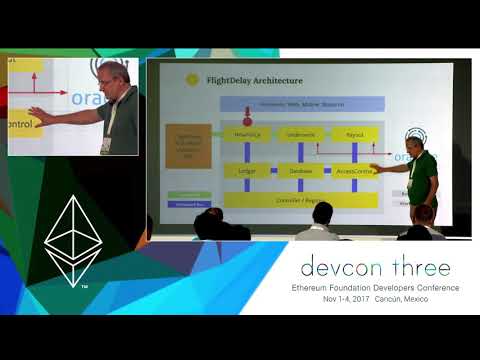

A Standardized Business Model for Decentralized Insurance

We at Etherisc are building the first decentralized insurance on the blockchain. Decentralized means that we are not building a company only, but a standardized protocol and a platform on which many participants can build insurance products and trade risks.

Christoph Mussenbrock

Devcon

Talk

19:18

Dai Stablecoin

The process of developing the Dai Stablecoin System has matured significantly over the course of the last year. We innovated in the Ethereum community by being the first project to release a well-defined reference implementation, written in Haskell, for our proposed system. This effort has helped with the simplification of the system’s design, increased project efficiency, and has attracted the attention of formal verificiation specialists who now want to focus on Maker. It is becoming more and more likely that Maker will be the first non-trivial decentralized application to be formally verified before launch. In this proposed presentation, I would like to talk about the usefulness of rigorous specification and external reference implementations for the benefit of other Ethereum projects.

Andy Milenius

Devcon

Breakout

04:05

Shaky ERC20 Allowances

Sometimes, we can't see the forest for the trees. When not used carefully in dapps, ERC20 token allowances fit that description perfectly. This presentation goes into the story of how I accidentally put over 10,000 DAI at risk for my users, even if they only deposited 100 DAI in the smart contract per se.

Paul Razvan Berg