devcon 6 / economic incentives and souls in schelling point based oracles

- YouTube

- IPFS

- Details

Economic Incentives and Souls in Schelling-point Based Oracles

Duration: 00:24:16

Speaker: William George

Type: Talk

Expertise: Intermediate

Event: Devcon

Date: Oct 2022

Schelling-point based oracles, such as Kleros, can be used to attribute soulbound tokens (SBTs) to individuals based on subjective evaluations of their backgrounds and expertise. Moreover, mechanisms using SBTs can complement economic incentives in such oracles; for example, an SBT-conscious random selection process can determine the voters on a given question. We will focus on how the interplay of economic and social elements in such systems can be designed to maximize resistance to attacks.

- Related

Devcon

Talk

25:38

Oracles for number values

We will overview the history and state of research on how to design a cryptoeconomic oracle that outputs a number value. One wants such tools for price oracles, but also for bringing other information on-chain, e.g. the damages to award from an on-chain insurance contract. We will look at approaches ranging from Vitalik's 2014 SchellingCoin proposal to ideas drawing from social choice theory, including based on recent research. We will explore tradeoffs including resistance to several attacks.

William George

Devcon

Talk

17:05

Nano-payments on Ethereum

Piotr Janiu of Golem (http://golemproject.net/) presents on Nano-payments on the Ethereum blockchain

Piotr Janiuk

Devcon

Talk

30:33

A Modest Proposal for Ethereum 2.0

Vitalik Buterin gives his talk titled, "A Modest Proposal for Ethereum 2.0"

Vitalik Buterin

Devcon

Talk

13:41

Synthetic Assets

Dominic Williams presents on Synthetic Assets at Ethereum's DEVCON1.

Dominic Williams

Devcon

Talk

20:54

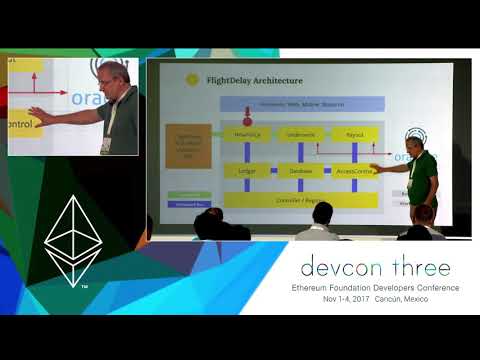

A Standardized Business Model for Decentralized Insurance

We at Etherisc are building the first decentralized insurance on the blockchain. Decentralized means that we are not building a company only, but a standardized protocol and a platform on which many participants can build insurance products and trade risks.

Christoph Mussenbrock

Devcon

Talk

19:18

Dai Stablecoin

The process of developing the Dai Stablecoin System has matured significantly over the course of the last year. We innovated in the Ethereum community by being the first project to release a well-defined reference implementation, written in Haskell, for our proposed system. This effort has helped with the simplification of the system’s design, increased project efficiency, and has attracted the attention of formal verificiation specialists who now want to focus on Maker. It is becoming more and more likely that Maker will be the first non-trivial decentralized application to be formally verified before launch. In this proposed presentation, I would like to talk about the usefulness of rigorous specification and external reference implementations for the benefit of other Ethereum projects.

Andy Milenius

Devcon

Breakout

04:05

Shaky ERC20 Allowances

Sometimes, we can't see the forest for the trees. When not used carefully in dapps, ERC20 token allowances fit that description perfectly. This presentation goes into the story of how I accidentally put over 10,000 DAI at risk for my users, even if they only deposited 100 DAI in the smart contract per se.

Paul Razvan Berg

Devcon

Talk

22:34

Cryptoeconomics Dive: LP Volatility Harvesting Across Yield Rates

This talk furthers the concept of volatility harvesting. Currently, Uniswap and other major dexes see a huge part of their trading volume consist of the result of volatility in the market. Value changes and as a result, trading volume spikes and LPs profit. When extending yield, which is also quite a volatile concept, to AMMs, volatility harvesting is increased further to not only affect value but also the yield that value creates.

Will Villanueva

Devcon

Talk

31:22

HyperCerts for Regenerative Cryptoeconomics

How do we incentivize and reward high-impact bets on valuable projects like infrastructure?Regenerative cryptoeconomics intends to combine a cultural paradigm shift with web3 tooling to incentivize positive externalities in a financially sustainable way. Evan will describe specific tools, instruments, and mechanisms; share developmental achievements made so far; and describe how those directions can improve the chances that the world will be improved with user-empowering, web3 driven tech.

Evan Miyazono

Devcon

Talk

21:51

Updates on Proposer-Builder Separation

In this talk, I will discuss updates on PBS and economic models for validators, builders, searchers and users.

Barnabé Monnot